12 Questions To Ask When Choosing A Tax Preparer

Your refund should never be deposited into your preparer’s bank account. The fastest and safest way to receive your refund is to have it directly deposited into your bank account. However, the Tax Department can also mail you a refund check.

- The fastest and safest way to receive your refund is to have it directly deposited into your bank account.

- Learn how to recognize the telltale signs of a scam and make sure you know how to tell if it’s really the IRS calling or knocking on your door.

- If you don’t feel comfortable with something, voice your concerns to your preparer.

- Slightly fewer than half of e-filed tax returns are self-prepared; paid tax preparers complete the rest.

In many cases, especially for people with low incomes, these features can increase the amount you could receive in a refund. There are some key factors to make sure you look out for. If you’ve been doing your taxes year after year and not much has changed in your financial or personal situation, you’ll likely be more than able to handle your next tax return. All information on this website is for general information only. There is no implied, legal, tax advice or financial guidance for any personal or business situation.

When choosing a tax professional, taxpayers should:

The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit. If your tax situation is complex, you may want to hire a professional tax preparer. Choose the preparer carefully because you will be legally responsible for the tax return even if someone prepares it for you. If your income is too high for Free File, you can buy software or use a tax preparation website; prices start around $20 and go up from there depending on your needs. The cost will increase if you need specialized software for self-employment income, rental income, farming income, or other more complex situations.

- Information about these cases is available on the Justice Department’s website.

- A paid tax professional will have an IRS Preparer Tax Identification Number (PTIN) and must include it on the tax returns they prepare.

- Otherwise, the software package that works best will depend on how complex your tax situation is.

- They’ll ask questions to figure things like the total income, tax deductions and credits.

- However, be smart, the IRS has a system to verify and recommend excellent tax preparers.

Service personnel can file the return online, designate the refund to their direct deposit account and receive their refund in about a week. You can find tax preparers through personal recommendations by friends or colleagues, through the phone book, or through professional organizations’ web sites. Tax preparers can prepare both federal and state tax forms.

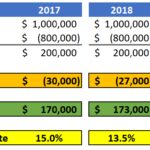

Deciding Point: The Cost

Otherwise, the software package that works best will depend on how complex your tax situation is. It is important to be sure the tax preparer has experience preparing tax forms for people in your particular situation. Not all tax preparers understand the non-resident tax forms such as the 1040NR. It is also https://kelleysbookkeeping.com/net-realizable-value-definition/ important to understand possible costs before agreeing to hire a tax preparer. The Armed Forces Tax Council provides free tax preparation services worldwide to military personnel and their families. These volunteers are specially trained to handle military specific issues such as combat zone tax benefits.

- There are different kinds of tax preparers, and a taxpayer’s needs will help determine which kind of preparer is best for them.

- Make sure the preparer will file your return electronically.

- There are several computer programs you can purchase or download that explain what to do step-by-step.

- You’ll find the 2016 tax rates (the ones you’ll use when you file in 2017) here.

- It is important to be sure the tax preparer has experience preparing tax forms for people in your particular situation.

Tiffany has prepared many Amended Tax Returns to save thousands of dollars for clients even if they used tax preparation software. Please read instructions and IRS publications for your special case if you use tax software. Keep related tax records and being organized could save you a lot of time and money. Many consumers use Taxpayers Should Check Out These Tips Before Choosing A Tax Preparer these types of loans because they want quick refunds. However, a cheaper and better alternative is for consumers to file their taxes electronically and have the refunds directly deposited into their own bank accounts. By doing this, you can still get your money back quickly, but without incurring interest and other loan fees.

Ask about service fees

Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest. You can also use tax preparation services or consult with financial experts, like certified public accountants or tax attorneys, when filing your return. Reputable tax professionals can assist with complex returns, and their expertise often provides peace of mind to consumers with concerns about their taxes.

Oct. 17 – Due date for taxpayers who request an extension to file, but this does not extend your payment. 1 – W-2 forms must be filed with the IRS & the SSA. Having a problem with a financial product or service? We have answers to frequently asked questions and can help you connect with companies if you have a complaint. The end of the 2023 tax season for most Americans is April 18, 2023. If you are unable to file before that date you still have options.

Alfonso Moraleja Juárez es Doctor en Filosofía y Ciencias de la Educación por la Universidad Autónoma de Madrid y Graduado en Ciencias Políticas por la UNED. En la actualidad, dirige en la Universidad Autónoma de Madrid la publicación de Filosofía y Letras Cuaderno Gris. Compagina la docencia en el IES Joan Miró con la de alumnos de altas capacidades (PEAC) y con los alumnos del Master MESOB en la UAM.

Alfonso Moraleja Juárez es Doctor en Filosofía y Ciencias de la Educación por la Universidad Autónoma de Madrid y Graduado en Ciencias Políticas por la UNED. En la actualidad, dirige en la Universidad Autónoma de Madrid la publicación de Filosofía y Letras Cuaderno Gris. Compagina la docencia en el IES Joan Miró con la de alumnos de altas capacidades (PEAC) y con los alumnos del Master MESOB en la UAM.